Oceanview Operations Update- Notice of Rate Lock on MYGA Products

/in Annuity News, Annuity Products/by Neal LaPierreA-CAP and AmeriLife Enhance APP Annuity with Addition of ESG Macro 5 Index from Credit Suisse

/in Annuity News, Annuity Products/by Neal LaPierreNew index offering from Credit Suisse addresses increasing demand for performative and sustainably focused investment opportunities

–News Direct–

A-CAP and AmeriLife today announced the addition of the Credit Suisse ESG Macro 5 Index (Bloomberg: CSEAGESG) to their industry-leading Accumulation Protector PlusSM (“APP”) Annuity, a 10-year fixed indexed annuity, offered through A-CAP’s subsidiaries, Sentinel Security Life Insurance Company and Atlantic Coast Life Insurance Company.

The Credit Suisse ESG Macro 5 Index will add an innovative, multi-asset approach, with a focus on environment, social and governance (ESG) standards. The index also offers exposure to components across regions and asset classes in an attempt to mitigate market unpredictability as well as benefit from opportunities across different market cycles and geographies.

“Two years ago, this month, we launched the APP Annuity offering exclusive access to the Credit Suisse Momentum Index and guaranteed participation rates for ten years. With a bespoke index designed to perform well in all market conditions, and a revolutionary, 10-year guaranteed participation rate product design, the APP Annuity was the first of its kind in our industry,” said Doug George, head of Life and Annuity for A-CAP. “Today, we are proud to further enhance the APP Annuity’s value by adding exclusive access to the Credit Suisse ESG Macro 5 Index with similar 10-year guaranteed participation rates.”

The fully rules-based Credit Suisse ESG Macro 5 Index provides a global equity component that offers exposure to a risk-weighted basket of four regional indices from leading ESG index provider MSCI, designed to maximize exposure to positive environmental, social and governance scores, as identified by MSCI. A basket of macro components, comprised of sub-strategies across fixed income, commodities and currencies components, further seeks to identify trend patterns in the markets and to benefit from the difference in yields between different instruments. Combined with a daily adjustment to target index volatility a 5% to generate consistent returns over time, the Credit Suisse ESG Macro 5 index seeks to combine stable growth with sustainably focused and impact investment.

“We are thrilled that A-CAP and AmeriLife have collaborated with Credit Suisse again,” said Andrew Ip Ping Wah, head of Insurance Solutions for Credit Suisse. “The Credit Suisse ESG Macro 5 Index provides a new option to policyholders wanting exposure to companies filtered through MSCI’s Environmental, Social and Governance criteria.”

“Since its launch in 2020, the APP Annuity has proven to be a differentiator for AmeriLife’s distribution and a key offering of our holistic product portfolio,” added Denny Southern, president of Annuity & Retirement Planning for AmeriLife. “The addition of the Credit Suisse ESG Macro 5 Index will only make this incredible product better by delivering the diversity, flexibility and performance that today’s discerning investors are craving.”

The product and indices described above are a summary only. All benefits and features are subject to the actual terms and conditions of the annuity contract. To learn more about the Accumulation Protector Plus℠ (“APP”) Annuity and the Credit Suisse ESG Macro 5 index, licensed agents and financial advisors can visit www.sslco.com/app, www.aclico.com/app, indices.credit-suisse.com/CSEAGESG, or contact Sentinel Security Life Insurance Company’s sales team at 800-247-1423 and Atlantic Coast Life Insurance Company’s sales team at 844-442-3847.

Attributions and Disclaimers with Respect to Credit Suisse

The Credit Suisse Momentum Index and the Credit Suisse ESG Macro 5 Index (the “Indices”) and “Credit Suisse”, and any trademarks, service marks and logos related thereto are service marks of Credit Suisse Group AG, Credit Suisse International, or one of their affiliates (collectively, “Credit Suisse”). Credit Suisse has no relationship to Atlantic Coast Life Insurance Company or Sentinel Security Life Insurance Company, other than the licensing of the Credit Suisse Momentum Index and the Credit Suisse ESG Macro 5 Index and its service marks for use in connection with the Accumulation Protector PlusSM Annuity and certain hedging arrangements and is not a party to any transaction contemplated hereby. Credit Suisse shall not be liable for the results obtained by using, investing in, or trading the Accumulation Protector PlusSM Annuity. Credit Suisse has not created, published or approved this document and accepts no responsibility or liability for its contents or use. Obligations to make payments under the Accumulation Protector PlusSM Annuity are solely the obligation of Atlantic Coast Life Insurance Company or Sentinel Security Life Insurance Company and are not the responsibility of Credit Suisse.

There is currently no universal definition or exhaustive list defining the issues or factors that are covered by the concept of “ESG” (Environmental, Social, Governance). Credit Suisse’s view of ESG is based solely on Credit Suisse’s current opinions, assumptions, and interpretations, which may evolve over time and are subject to change.

MSCI Indices are the exclusive property of MSCI Inc. (“MSCI”). MSCI and the MSCI index names are service mark(s) of MSCI or its affiliates and have been licensed for use for certain purposes by Credit Suisse. The financial product referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to such financial product. The annuity contract or other governing disclosure document contains a more detailed description of the limited relationship MSCI has with Credit Suisse and any related financial product. No purchaser, seller or holder of this financial product, or any other person or entity, should use or refer to any MSCI trade name, trademark or service mark to sponsor, endorse, market or promote this financial product without first contacting MSCI to determine whether MSCI’s permission is required. Under no circumstances may any person or entity claim any affiliation with MSCI without the prior written permission of MSCI.

###

About A-CAP

A-CAP is a holding company owning multiple insurance and financial businesses on its unique and synergistic platform. These businesses include primary insurance carriers, an SEC registered investment adviser, reinsurance vehicles, and marketing organizations. With broad knowledge across the insurance and investment sectors, A-CAP’s management team has diverse experience and provides comprehensive services to policyholders, insurance company clients and capital partners. Launched in 2013, A-CAP is a privately held company with offices located in New York, Charleston, Chicago, and Salt Lake City. For more information, visit www.acap.com.

About AmeriLife

AmeriLife’s strength is its mission: to provide insurance and retirement solutions to help people live longer, healthier lives. In doing so, AmeriLife has become recognized as the leader in developing, marketing, and distributing life and health insurance, annuities and retirement planning solutions to enhance the lives of pre-retirees and retirees across the United States. For more than 50 years, AmeriLife has partnered with top insurance carriers to provide value and quality to customers served through a distribution network of over 300,000 insurance agents and advisors and more than 100 marketing organizations and insurance agency locations nationwide. For more information, visit AmeriLife.com, and follow AmeriLife on Facebook and LinkedIn.

About Credit Suisse

Credit Suisse is one of the world’s leading financial services providers. The bank’s strategy builds on its core strengths: its position as a leading wealth manager, its specialist investment banking and asset management capabilities and its strong presence in its home market of Switzerland. Credit Suisse seeks to follow a balanced approach to wealth management, aiming to capitalize on both the large pool of wealth within mature markets as well as the significant growth in wealth in Asia Pacific and other emerging markets, while also serving key developed markets with an emphasis on Switzerland. The bank employs more than 50,000 people. The registered shares (CSGN) of Credit Suisse Group AG, are listed in Switzerland and, in the form of American Depositary Shares (CS), in New York. Further information about Credit Suisse can be found at www.credit-suisse.com.

Contact Details

AmeriLife

Jeff Maldonado

+1 321-297-1112

jmaldonado@amerilife.com

A-CAP

Kristen Jensen

+1 914-393-5472

kjensen@acap.com

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/a-cap-and-amerilife-enhance-app-annuity-with-addition-of-esg-macro-5-index-from-credit-suisse-572117742

IN THIS STORY

MSCI

Oceanview Harbourview Annuity Alert – Interest Rate Reduction Notice

/in Annuity Products/by Neal LaPierre

July 20, 2020

Oceanview Harbourview Annuity Alert – Interest Rate Reduction Notice

Effective Tuesday, July 28th, 2020, Oceanview Life and Annuity Company will be reducing the rates on our 3-year MYGA and 5-year MYGA products.

- · The new rate for the 3-year MYGA will be reduced to 2.50%

- · The new rate for the 5-Year MYGA will be reduced to 3.10%

- · The 7-year and 10-year MYGA rates will remain unchanged at 3.25%

- · *Commissions will remain the same on all four duration types.

Current rates will be applicable to all policy applications signed on or before Monday, July 27th, 2020, provided the applications are received by July 31st, 2020 to our New Business office in Grimes, IA.

Overnight Mail :

OCEANVIEW LIFE AND ANNUITY

1851 SE Miehe Drive

Grimes, IA 50111

or Fax to 1-888-417-3702

Rate Lock Policy: Provided the application is signed and received according to previously stated guidelines, we will allow 60 days from the sign date of the application to receive the funds

Access the upcoming rates here: OVLAC AGENT Rate Sheet Update 07.20.20

Computer network issues – Updated

/in Annuity News, Annuity Products, The Life And Annuity Shop News/by Neal LaPierre

July 21, 2020

Dear Valued Agents,

We are writing to let you know that The Life and Annuity Shop’s network environment was hit with a highly sophisticated virus injected from outside sources that has disrupted access to our computer systems. As soon as we discovered the incident, we immediately implemented our emergency response protocols and disconnected outside access to our network to contain the potential threat and protect data. We have initiated a comprehensive response plan and activated key partners to help us navigate and respond to the impacts of the virus.

Please be assured, our teams are working diligently to restore our systems as quickly as possible. We have also hired independent computer forensic firms to conduct an investigation and determine how this occurred, what we can do to prevent a similar attack in the future, and to confirm that no protected health information was impacted. As of now, there is no evidence to suggest that PHI, PII or HIPAA-related data maintained through our systems has been compromised.

We are still in the early stages of the investigation with limited information, however we are committed to open communication and will continue to provide updates as we progress through the restoration process. At The Life and Annuity Shop we pride ourselves on providing outstanding service, and are deeply sorry for the frustration and inconvenience this has caused you.

Computer network issues and office early closure on Monday 7/20/20

/in Annuity News, Annuity Products, The Life And Annuity Shop News/by Neal LaPierre The Life and annuity shop’s computer network issues that have affected our email, phones and other systems that we reported on Friday 7/17/20 are not completely restored. We have made the decision to close early again today 7/20/20 to allow IT to continue fix the issues.

The Life and annuity shop’s computer network issues that have affected our email, phones and other systems that we reported on Friday 7/17/20 are not completely restored. We have made the decision to close early again today 7/20/20 to allow IT to continue fix the issues.

We greatly apologize for this inconvenience to you. We didn’t make this decision lightly. We now expect to be back up and running on Tuesday 7/21/20 for normal business hours.

Computer network issues and office early closure

/in Annuity News, Annuity Products, The Life And Annuity Shop News/by Neal LaPierre The Life and annuity shop’s computer network is experiencing issues that have affected our email, phones and other systems. We have made the decision to close early today 7/17/20 at 10:30am EST to allow IT to fix the issues.

The Life and annuity shop’s computer network is experiencing issues that have affected our email, phones and other systems. We have made the decision to close early today 7/17/20 at 10:30am EST to allow IT to fix the issues.

We greatly apologize for this inconvenience to you. We didn’t make this decision lightly. We expect to be back up and running on Monday 7/20/20 for normal business hours.

Interest Rate Alert

/in Annuity News, Annuity Products/by Neal LaPierreDear Valued Producer,

I wanted to make sure all of you are aware of the dramatic recent changes in the financial markets, especially the bond market. The yield on the 10 year treasury has been declining for the last month but the decreases in yields have really accelerated over the past 5 days.

• On February 6, 2020 the yield on the 10 year treasury was 1.66%

• Today March 6, 2020 at 9:26am the yield on the 10 year treasury was 0.70%

• So over the last 30 days the yield on the 10 year treasury have dropped 96 bps!

• As a result investment yields on the insurance carrier’s portfolios are dropping and therefore they have lowered their new money rates and more importantly more Interest rate decreases are coming.

So I would strongly recommend that you meet with your clients and potential clients to advise them what is happening. Also encourage them to lock in the current rates now as it looks like interest rates will continue to go lower. Waiting will only end up costing them more money.

Please call us at (888) 661-1999 to discuss current annuity offerings available and upcoming interest rate decreases so you are aware of the time frames involved.

Below is a chart showing the decline in yield on the 10 year treasury over the last 30 days.

Neal Lapierre

President

The Life And Annuity Shop, LLC

Uncapped Accumulation FIA – 10% Bonus, 9% Comp & Top MYGA

/in Annuity News, Annuity Products/by Neal LaPierreBankers Life will suspend all new sales of BLIC products effective October 1, 2018

/in Annuity News, Annuity Products/by Neal LaPierreBankers Life will suspend all new sales of BLIC products effective October 1, 2018

Important Field Announcement

Click here for the original Field Announcement

Originally received via email on Thu 9/27/2018 10:46 PM

Dear Valued Agents,

As you know, just over 18 months ago Bankers Life Insurance Company became part of Global Bankers Insurance Group (Global Bankers), an international family of insurance and reinsurance companies focused on life insurance and annuities. We discussed this relationship and its potential to grow our organization as well as to create strategic and operational efficiencies to bring BLIC to the next level in terms of superior technology, improved product offerings and premier customer service.

Bankers Life Insurance is one of many insurance entities under Global Bankers, which manages a diverse portfolio of insurance companies in the U.S. and abroad. In order to take advantage of higher ratings, a diverse product portfolio and more efficient processes, we will be consolidating all future annuity sales into Global Bankers’ flagship company, Colorado Bankers Life Insurance Company (CBLife). CBLife has invested a tremendous amount of time and resources in perfecting a state-of-the-art digital platform featuring enhancements such as policy eDelivery and eApplications. We feel trying to replicate this effort across multiple companies is not prudent.

Therefore, at this time we will suspend all new sales of BLIC products effective October 1, 2018. As in the past with similar situations, we will honor all annuity applications in the pipeline. However, BLIC will accept no new business annuity applications after October 1st.

Please note: There will be no interruption in service to your clients and/or contract owners. The customer service quality they are accustomed to receiving will continue uninterrupted.

For more than 40 years Bankers Life Insurance Company has provided quality deferred and immediate annuity products, services and support to our policyholders across America. You have been an integral part of our history. On behalf of every member of the BLIC team, I wish to thank you for your loyalty and all that you have done to make what Bankers Life Insurance Company is today.

Sincerely,

John Muscolino

Give Your Business Some RPMs – Introducing Retirement Plus Multiplier Annuity

/in Annuity Products/by Neal LaPierreIt’s Summer Time Again and Interest Rates are heating up along with the Weather!

/in Annuity Products/by Neal LaPierreSentinel Security Life Annuity Rate increase Effective 11/01/2017

/in Annuity Products/by Neal LaPierre

Personal Choice – MYGA Rate Increase Effective 11/01/2017

MYGA crediting rates for all guarantee periods will increase by 10 bps effective November 1, 2017! To view updated rates, please download a copy of the current Rate Sheet below.

These new rates will be applied to all contracts issued on or after 11/01/2017 regardless of the date the application was received.

Atlantic Coast Life – Annuity Rate increase Effective 11/01/2017

/in Annuity Products/by Neal LaPierreAtlantic Coast Life – Annuity Rate increase Effective 11/01/2017

Safe Harbor and Safe Haven Rate Increase – Effective November 1, 2017 We are excited to announce that our Safe Harbor and Safe Haven crediting rates for all guarantee periods will increase by 10 bps effective November 1, 2017! To view our updated rates, please download a copy of the current Rate Sheet from our website or by following the link below. These new rates will be applied to all contracts issued on or after 11/01/2017 regardless of the date the application was received. |

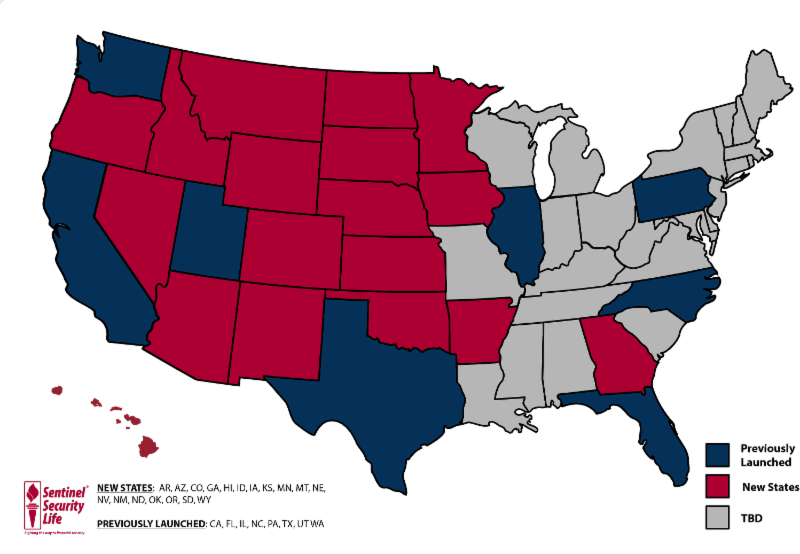

Summit Bonus Index Annuity Available in More States – Effective 10/23/17

/in Annuity Products/by Neal LaPierreSummit Bonus Index Annuity Available in More States – Effective 10/23/17

We are excited to announce the expansion of Sentinel Security Life Insurance Company’s Summit Bonus Index annuity product into additional states! The following states are set to release on 10/23/2017; AR, AZ, CO, GA, HI, ID, IA, KS, MN, MT, NE, NV, NM, ND, OK, OR, SD, WY.

Below are a few product highlights of the Summit Bonus Index Annuity:

- Income Rider with high payout factors

- Premium Bonus up to 8%

- 4 Indexing Strategies to allocate money

- Issue Age 0-80

- Minimum Single Premium $5,000 (Qualified) $10,000 (Non-Qualified)

- Maximum Single Premium $1,000,000 (Larger amounts will be considered with Home Office Approval)

For currently contracted producers, All of the product brochures, quick sheets, and forms are available to order, download or print from Sentinel Security Life Insurance Company’s Agent Portal.

If you aren’t contracted yet, contact us at 888-661-1999.

Click on the link below for the updated rate sheet.

Reminder: Agents may write business up to one week prior to the launch date for each new state, however business will not be issued until after the effective date.

Introducing Our Newest Annuity – Personal Choice Plus+

/in Annuity Products/by Neal LaPierre

Personal Choice Plus+ Annuity

We are excited to announce the addition of our most customizable annuity to our Sentinel Security Life product family!

Introducing the Personal Choice Plus+ Annuity – a balanced hybrid of a traditional MYGA and FIA. This product offers both flexible riders and four indexing options directly tied to the S&P 500.

- Strong fixed index rate guaranteed for five years

- Four Optional Riders

- Unique Enhanced Death Benefit rider

- High Caps

This product is scheduled to be released on July 24, 2017.

We encourage you to sign up for product specific training. The training will take place every Monday at 2:00 pm MDT and Wednesday at 10:00 am MDT and will continue for one month.

You can sign up for one of the webinar training times here:

https://attendee.gotowebinar.com/rt/2956862028700065283

In the meantime, Call us to learn more about this exciting new product.

1-888-661-1999

Introducing Our Newest Annuity – Safe Anchor Market Guarantee

/in Annuity Products/by Neal LaPierre

Safe Anchor Market Guarantee

We are excited to announce the addition of our most customizable annuity to our Atlantic Coast Life product family!

Introducing the Safe Anchor Market Guarantee Annuity – a balanced hybrid of a traditional MYGA and FIA. This product offers both flexible riders and four indexing options directly tied to the S&P 500.

- Strong fixed index rate guaranteed for five years

- Four Optional Riders

- Unique Enhanced Death Benefit rider

- High Caps

This product is scheduled to be released on July 24, 2017.

We encourage you to sign up for product specific training. The training will take place by webinar every Tuesday at 9:00 am MDT and Thursday at 9:00 am MDT, and will continue for one month.

You can sign up for one of the eight training times here:

https://attendee.gotowebinar.com/rt/5055783546636422914

In the meantime, Call us to learn more about this exciting new product.

1-888-661-1999

For agent use only.

Atlantic Coast Life – Annuity Rate decrease Effective 7/01/2017

/in Annuity Products/by Neal LaPierreAtlantic Coast Life – Annuity Rate decrease Effective 7/01/2017

Based on current market conditions Atlantic Coast Life is lowering the crediting rates on the Safe Haven and Safe Harbor Bonus Guarantee Annuities. Effective July 1, 2017, the 5, 6, 7, 10, and 20-year rates will be reduced by 10 bps. Important Dates to Remember

New Business Fax: 888-433-4795

|

Sentinel Security Life Annuity Rate decrease Effective 7/01/2017

/in Annuity Products/by Neal LaPierre

Personal Choice – MYGA Rate Adjustment Effective 07/01/2017

Based on current market conditions we are lowering the crediting rates on the Sentinel Personal Choice Annuity. Effective July 1, 2017, the 5-year, 7-year and 10-year rates will be reduced by 10 bps.

Summit Bonus Index – Indexing Strategy Caps Adjustment

Effective 07/01/2017

Based on current market conditions, we are lowering the indexing strategy caps on the Summit Bonus Index effective July 1, 2017.

Important Dates to Remember

- June 30, 2017 – Date application must be signed to receive current interest rates and indexing strategy caps. Applications must be signed by June 30, 2016 or before to receive the current interest rates and indexing strategy caps.

- July 1, 2017 – Date when new interest rates and indexing strategy caps takes effect. Any application signed on July 1, 2017 and later will receive the new interest rates and indexing strategy caps.

- July 7, 2017 – Date application must be received in the Home Office to receive current interest rates and indexing strategy caps. Applications signed by June 30, 2017 or earlier must be received in the Home Office on July 7, 2017 to receive the current interest rates and indexing strategy caps. We will accept faxed or emailed applications on July 7, 2017. New Business Email: newbusiness@sslco.com

New Business Fax: 888-433-4795

August 14, 2017 – Date 45-day rate lock ends. All transfers and exchanges for any application signed on June 30, 2017 or earlier must be completed by August 14, 2017 in order to receive the current interest rates and indexing strategy caps.

The 3.10%* MYGA Interest Rate Special is Back!

/in Annuity Products/by Neal LaPierreThe 3.10%* MYGA Interest Rate Special is Back!

Back by Popular Demand – 3.10% MYGA Interest Rate

Fidelity & Guaranty Life’s FG Guarantee-Platinum single premium fixed deferred annuity with a five-year guarantee period will increase to 3.10%. The 3.10% enhanced rate offers the following to your clients, all at no cost!

- Full accumulation value at death

- RMD friendly

- Nursing Home Rider

- Terminal Illness Rider

This higher rate is back on June 15, 2017 and will also be available in California and New Jersey.

Please click below for details. You can also visit the MYGA Wiki or contact us directly at 888-661-1999 with any additional questions

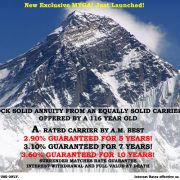

3.05% Guaranteed for 6 Years – liquidity features included, “A” Rated Carrier

/in Annuity Products/by Neal LaPierreMulti-year Guarantee Annuities… A Safe Haven for today’s uncertain world.

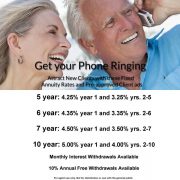

/in Annuity Products/by The Life and Annuity ShopAtlantic Coast Life’s Multi-Year Guaranteed Annuities

/in Annuity Products/by The Life and Annuity ShopCheck out Atlantic Coast Life’s Outstanding Multi-Year Guaranteed Annuities

Choice of 5, 6, 7 or 10 year surrender

- This annuity was created with the flexibility to meet the need of your clients.

- Industry Leading Interest Rates available as simple or compound interest crediting.

- Optional riders: (see rate sheet below for rider cost)

- Preferred 10.00% withdrawal

- Death benefit Feature

- Accumulated interest withdrawal

- Visit our agent friendly Atlantic Coast Life MYGA Microsite

- Atlantic Coast Life-Rates-1-1-16

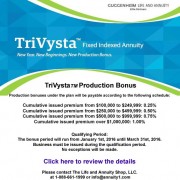

TriVysta Fixed Indexed Annuity from Guggenheim Life and Annuity Company

/in Annuity Products/by wpannuity1Disclaimer

This site is not for the general public. It is for licensed insurance agents only.

No portion of this Web site, or information contained therein, can be reproduced on other public or private Web sites without express written consent by

The Life and Annuity Shop, LLC. Failure to comply with this policy will result in legal penalties.

Not affiliated with the U. S. government or federal Medicare program. This website is designed to provide general information on Insurance products, including Annuities. It is not, however, intended to provide specific legal or tax advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. Please note that The Life and Annuity Shop, its affiliated companies, and their representatives and employees do not give legal or tax advice. Encourage your clients to consult their tax advisor or attorney.

Latest Product & Annuity News

Memorial-Day Observance – Our offices will be closed Monday, May 26thMay 22, 2025 - 9:46 AM

Memorial-Day Observance – Our offices will be closed Monday, May 26thMay 22, 2025 - 9:46 AM New Limited Distribution| FIAMarch 13, 2025 - 12:15 PM

New Limited Distribution| FIAMarch 13, 2025 - 12:15 PM Axonic Waypoint MYGAFebruary 24, 2025 - 4:18 PM

Axonic Waypoint MYGAFebruary 24, 2025 - 4:18 PM ❄️ Best Wishes This Holiday Season ❄️ and Holiday Office ClosuresDecember 20, 2024 - 2:25 PM

❄️ Best Wishes This Holiday Season ❄️ and Holiday Office ClosuresDecember 20, 2024 - 2:25 PM Thanksgiving 2024 Holiday HoursNovember 25, 2024 - 2:38 PM

Thanksgiving 2024 Holiday HoursNovember 25, 2024 - 2:38 PM