❄️ Best Wishes This Holiday Season ❄️ and Holiday Office Closures

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

We appreciate your business and wish you the best in the coming year

The Life and Annuity Shop, LLC.’s office will close early at 1:00 PM on Tuesday, December 24, 2024 and be closed Wednesday, December 25, 2024.

Also our office will close early at 1:00 PM on Tuesday, December 31, 2024 and Reopen on Thursday, January 2, 2025 Regular business hours will resume following the new year holiday.

Our Office will be CLOSING (Again) Tuesday 10/8/24. And will remain closed Wednesday 10/9/24 & Thursday 10/10/24. due to Hurricane Milton

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreHurricane Milton is a Major Hurricane & is approaching Florida over the next 36 hours. Our office and many of our staff members homes are now under a Mandatory Evacuation Order. The safety of our staff and their families is our top priority.

As a result, We are going to close the office Tuesday tomorrow 10/8/24. And will remain closed Wednesday 10/9/24 and Thursday 10/10/24. Currently, we plan to be open on Friday but that is conditional on the weather, Road conditions ect.

Please reach out to us via email while dependent on power and internet availability we will respond as quickly as possible.

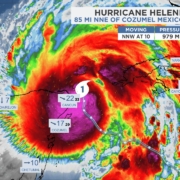

Our Office will be CLOSING at 12 Noon EST Wednesday, September 25 & remain CLOSED Thursday, September 26 due to Hurricane Helene

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreHurricane Helene is forecasted to rapidly intensify into a Major Hurricane as it approaches Florida over the next 24 hours. Our office and many of our staff members homes are now under a Mandatory Evacuation Order. The safety of our staff and their families is our top priority.

As a result, we are going to close the office today 9/25/24 at 12 noon today. And will remain closed tomorrow 9/26/24. Currently, we plan to be open on Friday but that is conditional on the weather, Road conditions ect.

Please reach out to us via email while dependent on power and internet availability we will respond as quickly as possible.

The Life and Annuity Shop – Labor Day Weekend Holiday Hours

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

The Life and Annuity Shop Office will close at 1:00pm EST this Friday, August 30th and remain closed on Monday, September 2nd in observance of Labor Day.

We will return to normal business hours on Tuesday, September 3rd. Have a wonderful holiday weekend!

Did you know the following Labor Day fun facts?

The first U.S. Labor Day celebration was held on Sept. 5, 1882 in New York City.

In 1894, Congress passed legislation and President Grover Cleveland signed into law a bill making the first Monday in September the official Labor Day federal holiday.

Labor Day recognizes the contributions of the more than 164 million men and women in the U. S. workforce.

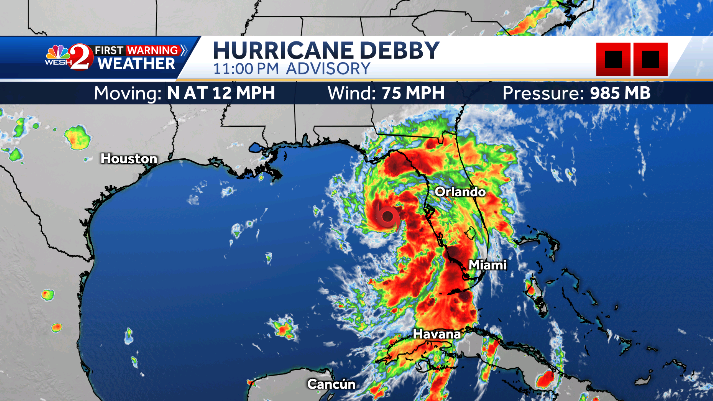

Office closure due to inclement weather due to Debbie hurricane

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreOur office will be opening late today Monday August 1, 2024 due to inclement weather due to Debbie hurricane. This may become a full day office closure as our staff’s safety is our number one priority. We are assessing the weather and road conditions and will open as soon as it safe to do so. We apologize for any inconvenience this may cause as we very much value your business.

4th of July Hours Announcement 2024

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreMemorial-Day Observance – Our offices will be closed Monday, May 26th

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreOceanview Operations Update- Notice of Rate Lock on MYGA Products

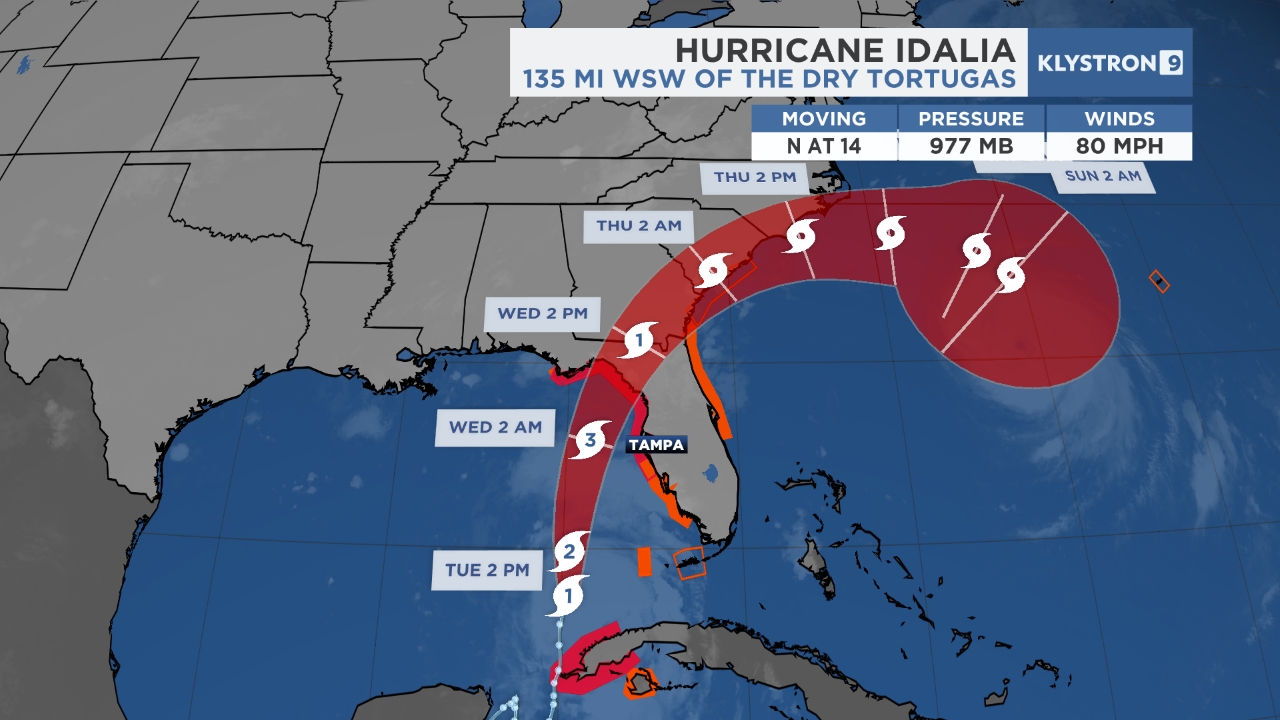

/in Annuity News, Annuity Products/by Neal LaPierreOur Office will be CLOSED Tuesday, August 29 to Wednesday, August 30th due to Hurricane Idalia

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreAs Hurricane Idalia approaches Florida, the safety of our staff and their families is our top priority. For this reason, Our office will be closed on Tuesday, August 29 to Wednesday, August 30th . Our Disaster Response Team will continue to monitor the path of the hurricane.

Hurricane Idalia

Memorial-Day Observance – our offices will be closed Monday, May 29th

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

The Life and Annuity Shop Staff honors and remembers the heroes who sacrificed in the service and protection of our country.

In observance of Memorial Day, The Life and Annuity Shop offices will close at 1:00 PM Eastern on Friday, May 26th and will reopen Tuesday, May 30th.

❄️ Best Wishes This Holiday Season ❄️ and Holiday Office Closures

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

We appreciate your business and wish you the best in the coming year

The Life and Annuity Shop, LLC.’s office will be closed Monday, December 26th, 2022 and Monday, January 2nd, 2023. Regular business hours will resume following the new year holiday, on January 3rd, 2023.

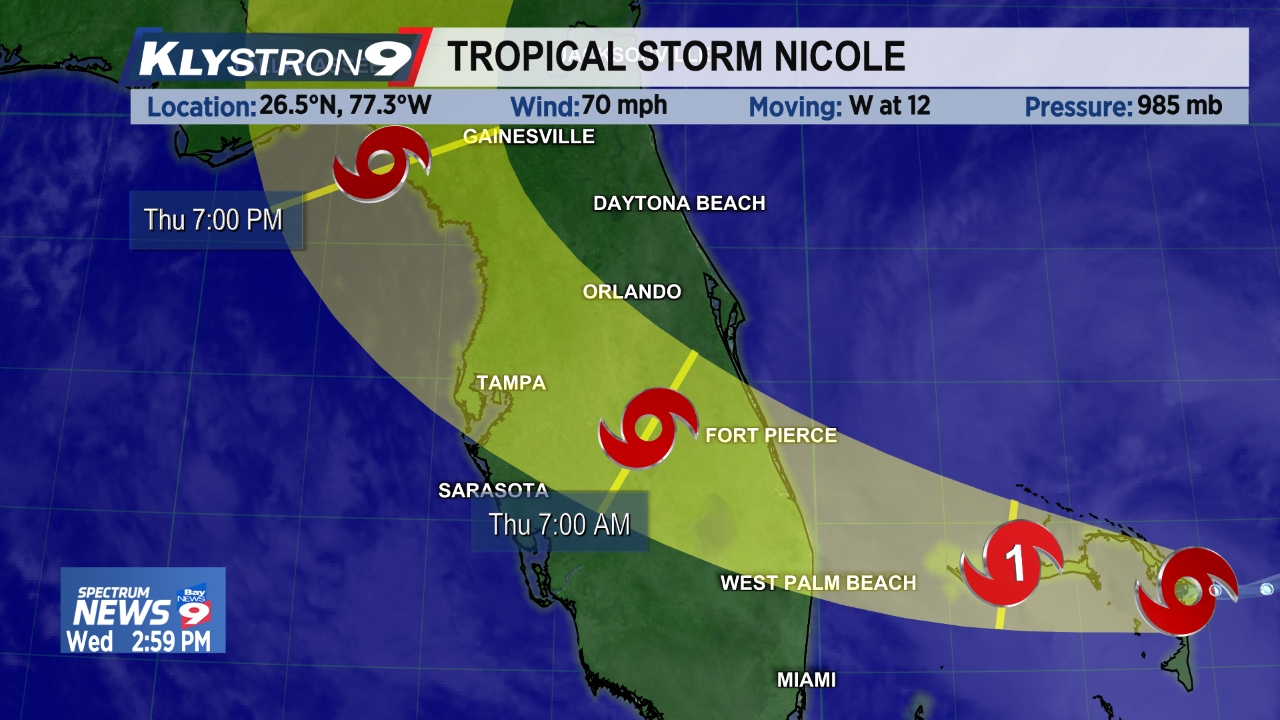

Our Office will be CLOSED Thursday, November 10 due to Tropical Storm Nicole

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreAs Tropical Storm Nicole approaches Florida, the safety of our staff and their families is our top priority. For this reason, Our Office will be CLOSED Thursday, November 10. Our Disaster Response Team will continue to monitor the path of the Storm.

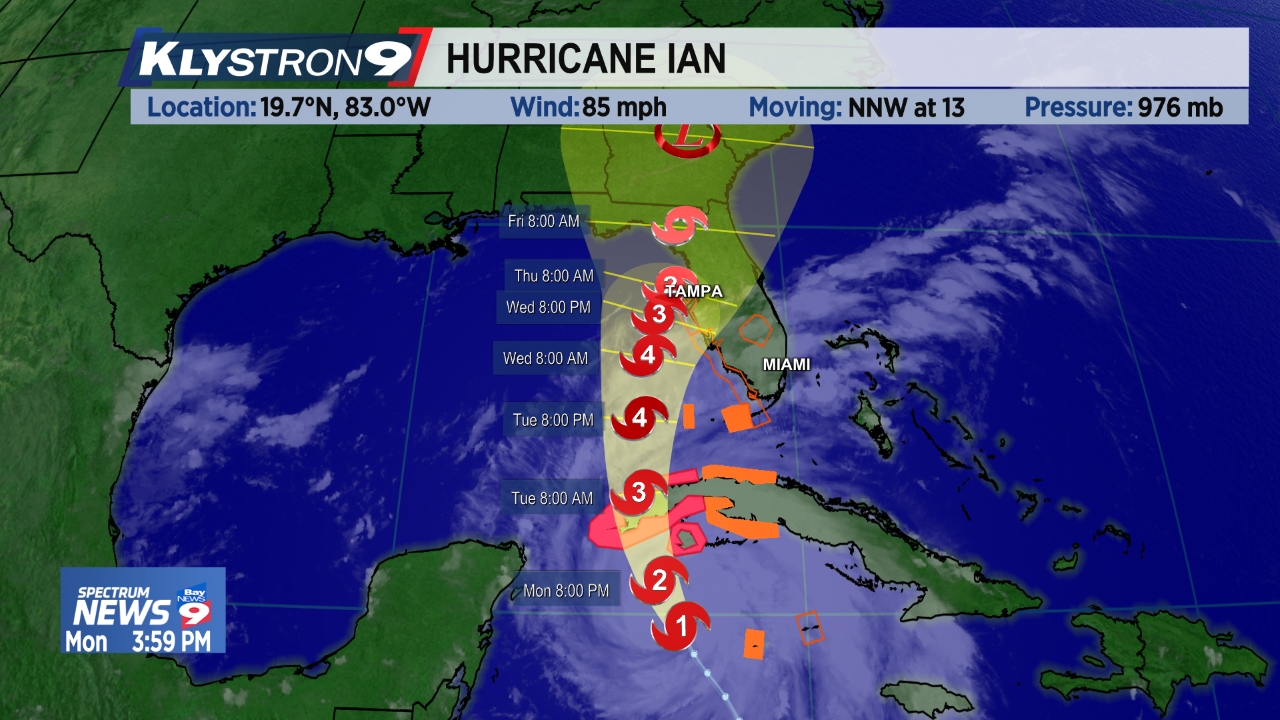

Our Office will be CLOSED Tuesday, Sept 27 to Thursday, Sept 29th due to Hurricane IAN

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreAs Hurricane Ian approaches Florida, the safety of our staff and their families is our top priority. For this reason, Our office will be closed on Tuesday, Sept 27th to Thursday, Sept 29th. Our Disaster Response Team will continue to monitor the path of the hurricane.

A-CAP and AmeriLife Enhance APP Annuity with Addition of ESG Macro 5 Index from Credit Suisse

/in Annuity News, Annuity Products/by Neal LaPierreNew index offering from Credit Suisse addresses increasing demand for performative and sustainably focused investment opportunities

–News Direct–

A-CAP and AmeriLife today announced the addition of the Credit Suisse ESG Macro 5 Index (Bloomberg: CSEAGESG) to their industry-leading Accumulation Protector PlusSM (“APP”) Annuity, a 10-year fixed indexed annuity, offered through A-CAP’s subsidiaries, Sentinel Security Life Insurance Company and Atlantic Coast Life Insurance Company.

The Credit Suisse ESG Macro 5 Index will add an innovative, multi-asset approach, with a focus on environment, social and governance (ESG) standards. The index also offers exposure to components across regions and asset classes in an attempt to mitigate market unpredictability as well as benefit from opportunities across different market cycles and geographies.

“Two years ago, this month, we launched the APP Annuity offering exclusive access to the Credit Suisse Momentum Index and guaranteed participation rates for ten years. With a bespoke index designed to perform well in all market conditions, and a revolutionary, 10-year guaranteed participation rate product design, the APP Annuity was the first of its kind in our industry,” said Doug George, head of Life and Annuity for A-CAP. “Today, we are proud to further enhance the APP Annuity’s value by adding exclusive access to the Credit Suisse ESG Macro 5 Index with similar 10-year guaranteed participation rates.”

The fully rules-based Credit Suisse ESG Macro 5 Index provides a global equity component that offers exposure to a risk-weighted basket of four regional indices from leading ESG index provider MSCI, designed to maximize exposure to positive environmental, social and governance scores, as identified by MSCI. A basket of macro components, comprised of sub-strategies across fixed income, commodities and currencies components, further seeks to identify trend patterns in the markets and to benefit from the difference in yields between different instruments. Combined with a daily adjustment to target index volatility a 5% to generate consistent returns over time, the Credit Suisse ESG Macro 5 index seeks to combine stable growth with sustainably focused and impact investment.

“We are thrilled that A-CAP and AmeriLife have collaborated with Credit Suisse again,” said Andrew Ip Ping Wah, head of Insurance Solutions for Credit Suisse. “The Credit Suisse ESG Macro 5 Index provides a new option to policyholders wanting exposure to companies filtered through MSCI’s Environmental, Social and Governance criteria.”

“Since its launch in 2020, the APP Annuity has proven to be a differentiator for AmeriLife’s distribution and a key offering of our holistic product portfolio,” added Denny Southern, president of Annuity & Retirement Planning for AmeriLife. “The addition of the Credit Suisse ESG Macro 5 Index will only make this incredible product better by delivering the diversity, flexibility and performance that today’s discerning investors are craving.”

The product and indices described above are a summary only. All benefits and features are subject to the actual terms and conditions of the annuity contract. To learn more about the Accumulation Protector Plus℠ (“APP”) Annuity and the Credit Suisse ESG Macro 5 index, licensed agents and financial advisors can visit www.sslco.com/app, www.aclico.com/app, indices.credit-suisse.com/CSEAGESG, or contact Sentinel Security Life Insurance Company’s sales team at 800-247-1423 and Atlantic Coast Life Insurance Company’s sales team at 844-442-3847.

Attributions and Disclaimers with Respect to Credit Suisse

The Credit Suisse Momentum Index and the Credit Suisse ESG Macro 5 Index (the “Indices”) and “Credit Suisse”, and any trademarks, service marks and logos related thereto are service marks of Credit Suisse Group AG, Credit Suisse International, or one of their affiliates (collectively, “Credit Suisse”). Credit Suisse has no relationship to Atlantic Coast Life Insurance Company or Sentinel Security Life Insurance Company, other than the licensing of the Credit Suisse Momentum Index and the Credit Suisse ESG Macro 5 Index and its service marks for use in connection with the Accumulation Protector PlusSM Annuity and certain hedging arrangements and is not a party to any transaction contemplated hereby. Credit Suisse shall not be liable for the results obtained by using, investing in, or trading the Accumulation Protector PlusSM Annuity. Credit Suisse has not created, published or approved this document and accepts no responsibility or liability for its contents or use. Obligations to make payments under the Accumulation Protector PlusSM Annuity are solely the obligation of Atlantic Coast Life Insurance Company or Sentinel Security Life Insurance Company and are not the responsibility of Credit Suisse.

There is currently no universal definition or exhaustive list defining the issues or factors that are covered by the concept of “ESG” (Environmental, Social, Governance). Credit Suisse’s view of ESG is based solely on Credit Suisse’s current opinions, assumptions, and interpretations, which may evolve over time and are subject to change.

MSCI Indices are the exclusive property of MSCI Inc. (“MSCI”). MSCI and the MSCI index names are service mark(s) of MSCI or its affiliates and have been licensed for use for certain purposes by Credit Suisse. The financial product referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to such financial product. The annuity contract or other governing disclosure document contains a more detailed description of the limited relationship MSCI has with Credit Suisse and any related financial product. No purchaser, seller or holder of this financial product, or any other person or entity, should use or refer to any MSCI trade name, trademark or service mark to sponsor, endorse, market or promote this financial product without first contacting MSCI to determine whether MSCI’s permission is required. Under no circumstances may any person or entity claim any affiliation with MSCI without the prior written permission of MSCI.

###

About A-CAP

A-CAP is a holding company owning multiple insurance and financial businesses on its unique and synergistic platform. These businesses include primary insurance carriers, an SEC registered investment adviser, reinsurance vehicles, and marketing organizations. With broad knowledge across the insurance and investment sectors, A-CAP’s management team has diverse experience and provides comprehensive services to policyholders, insurance company clients and capital partners. Launched in 2013, A-CAP is a privately held company with offices located in New York, Charleston, Chicago, and Salt Lake City. For more information, visit www.acap.com.

About AmeriLife

AmeriLife’s strength is its mission: to provide insurance and retirement solutions to help people live longer, healthier lives. In doing so, AmeriLife has become recognized as the leader in developing, marketing, and distributing life and health insurance, annuities and retirement planning solutions to enhance the lives of pre-retirees and retirees across the United States. For more than 50 years, AmeriLife has partnered with top insurance carriers to provide value and quality to customers served through a distribution network of over 300,000 insurance agents and advisors and more than 100 marketing organizations and insurance agency locations nationwide. For more information, visit AmeriLife.com, and follow AmeriLife on Facebook and LinkedIn.

About Credit Suisse

Credit Suisse is one of the world’s leading financial services providers. The bank’s strategy builds on its core strengths: its position as a leading wealth manager, its specialist investment banking and asset management capabilities and its strong presence in its home market of Switzerland. Credit Suisse seeks to follow a balanced approach to wealth management, aiming to capitalize on both the large pool of wealth within mature markets as well as the significant growth in wealth in Asia Pacific and other emerging markets, while also serving key developed markets with an emphasis on Switzerland. The bank employs more than 50,000 people. The registered shares (CSGN) of Credit Suisse Group AG, are listed in Switzerland and, in the form of American Depositary Shares (CS), in New York. Further information about Credit Suisse can be found at www.credit-suisse.com.

Contact Details

AmeriLife

Jeff Maldonado

+1 321-297-1112

jmaldonado@amerilife.com

A-CAP

Kristen Jensen

+1 914-393-5472

kjensen@acap.com

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/a-cap-and-amerilife-enhance-app-annuity-with-addition-of-esg-macro-5-index-from-credit-suisse-572117742

IN THIS STORY

MSCI

The Life and Annuity Shop – Labor Day Weekend Holiday Hours

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

The Life and Annuity Shop Office will close at 1:00pm EST this Friday, September 2nd and remain closed on Monday, September 5th in observance of Labor Day.

We will return to normal business hours on Tuesday, September 6th. Have a wonderful holiday weekend!

Did you know the following Labor Day fun facts?

The first U.S. Labor Day celebration was held on Sept. 5, 1882 in New York City.

In 1894, Congress passed legislation and President Grover Cleveland signed into law a bill making the first Monday in September the official Labor Day federal holiday.

Labor Day recognizes the contributions of the more than 164 million men and women in the U. S. workforce.

Memorial-Day Observance – our offices will be closed Monday, May 30th

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

The Life and Annuity Shop Staff honors and remembers the heroes who sacrificed in the service and protection of our country.

In observance of Memorial Day, The Life and Annuity Shop offices will close at 1:00 PM Eastern on Friday, May 27th and will reopen Tuesday, May 31st.

Holiday Office Closures

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

The Life and Annuity Shop, LLC.’s office will be closed Monday, December 26th, 2022 and Monday, January 2nd, 2023. Regular business hours will resume following the new year holiday, on January 3rd, 2023.

Veterans Day 2021

/in Annuity News/by Neal LaPierre

On November 11, 2021, we pause to reflect on the history of this great Nation and honor all those who fought to defend it. Originally called “Armistice Day” and intended to celebrate the end of World War I, “the war to end all wars,” Veterans Day allows us to give thanks to veterans past and present, men and women from all walks of life and all ethnicities, who stood up and said, “Send me.” We recognize your sacrifices, your sense of duty and your love for this country.

The Life and Annuity Shop – Labor Day Weekend Holiday Hours

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

The Life and Annuity Shop Office will close at 1:00pm EST this Friday, September 3rd and remain closed on Monday, September 6th in observance of Labor Day.

We will return to normal business hours on Tuesday, September 7th. Have a wonderful holiday weekend!

Did you know the following Labor Day fun facts?

The first U.S. Labor Day celebration was held on Sept. 5, 1882 in New York City.

In 1894, Congress passed legislation and President Grover Cleveland signed into law a bill making the first Monday in September the official Labor Day federal holiday.

Labor Day recognizes the contributions of the more than 164 million men and women in the U. S. workforce.

Office Closure -Tropical Storm Elsa

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreOur office will be closing early at 2pm Tuesday July 6th, 2021 due to Tropical Storm Elsa. We will evaluate our ability to re-open on Wednesday July 7th, 2021 early Wednesday Morning as the safety of our staff is our highest priority.

4th of July Hours Announcement

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

4th of July Hours Announcement

In observance of Independence Day, The Life and Annuity Shop will be closed Monday, July 5, 2021. We will resume normal business operations Tuesday, July 6th, at 8:15am Eastern.

Memorial-Day Observance – our offices will be closed Monday, May 31st.

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

The Life and Annuity Shop Staff honors and remembers the heroes who sacrificed in the service and protection of our country.

In observance of Memorial Day, our offices will be closed Monday, May 31st.

We will resume normal business hours Tuesday, June 1st.

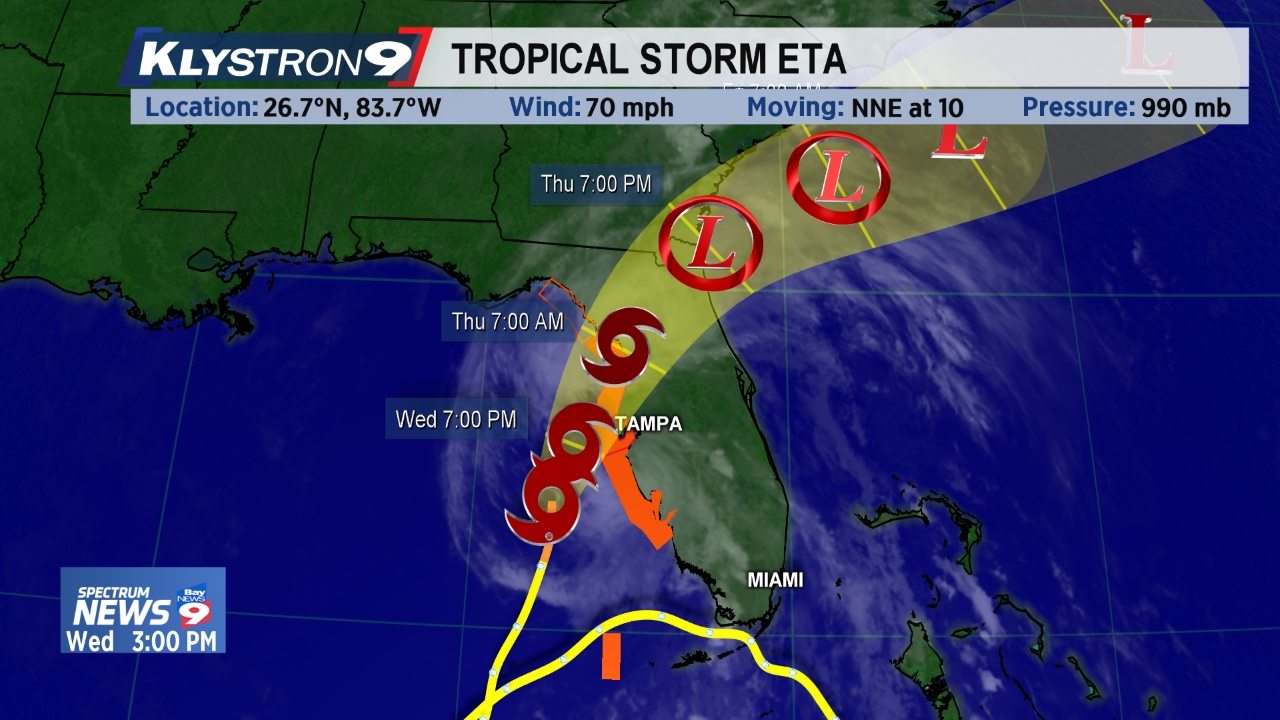

Office Closure -Tropical Storm ETA

/in Annuity News/by Neal LaPierreOur office will be closing early at 3pm Wednesday November 11, 2020 due to Tropical Storm ETA. We will evaluate our ability to re-open on Thursday early Thursday Morning as the safety of our staff is our highest priority.

Computer network issues – Updated

/in Annuity News, Annuity Products, The Life And Annuity Shop News/by Neal LaPierre

July 21, 2020

Dear Valued Agents,

We are writing to let you know that The Life and Annuity Shop’s network environment was hit with a highly sophisticated virus injected from outside sources that has disrupted access to our computer systems. As soon as we discovered the incident, we immediately implemented our emergency response protocols and disconnected outside access to our network to contain the potential threat and protect data. We have initiated a comprehensive response plan and activated key partners to help us navigate and respond to the impacts of the virus.

Please be assured, our teams are working diligently to restore our systems as quickly as possible. We have also hired independent computer forensic firms to conduct an investigation and determine how this occurred, what we can do to prevent a similar attack in the future, and to confirm that no protected health information was impacted. As of now, there is no evidence to suggest that PHI, PII or HIPAA-related data maintained through our systems has been compromised.

We are still in the early stages of the investigation with limited information, however we are committed to open communication and will continue to provide updates as we progress through the restoration process. At The Life and Annuity Shop we pride ourselves on providing outstanding service, and are deeply sorry for the frustration and inconvenience this has caused you.

Computer network issues and office early closure on Monday 7/20/20

/in Annuity News, Annuity Products, The Life And Annuity Shop News/by Neal LaPierre The Life and annuity shop’s computer network issues that have affected our email, phones and other systems that we reported on Friday 7/17/20 are not completely restored. We have made the decision to close early again today 7/20/20 to allow IT to continue fix the issues.

The Life and annuity shop’s computer network issues that have affected our email, phones and other systems that we reported on Friday 7/17/20 are not completely restored. We have made the decision to close early again today 7/20/20 to allow IT to continue fix the issues.

We greatly apologize for this inconvenience to you. We didn’t make this decision lightly. We now expect to be back up and running on Tuesday 7/21/20 for normal business hours.

Computer network issues and office early closure

/in Annuity News, Annuity Products, The Life And Annuity Shop News/by Neal LaPierre The Life and annuity shop’s computer network is experiencing issues that have affected our email, phones and other systems. We have made the decision to close early today 7/17/20 at 10:30am EST to allow IT to fix the issues.

The Life and annuity shop’s computer network is experiencing issues that have affected our email, phones and other systems. We have made the decision to close early today 7/17/20 at 10:30am EST to allow IT to fix the issues.

We greatly apologize for this inconvenience to you. We didn’t make this decision lightly. We expect to be back up and running on Monday 7/20/20 for normal business hours.

Memorial-Day Observance – our offices will be closed Monday, May 25th.

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

The Life and Annuity Shop Staff honors and remembers the heroes who sacrificed in the service and protection of our country.

In observance of Memorial Day, our offices will be closed Monday, May 25th.

We will resume normal business hours Tuesday, May 26th.

Impress/Reassure Clients During Pandemic

/in Annuity News/by Neal LaPierreImpress/Reassure Clients During Pandemic

By Bryce Sanders – InsuranceNewsNet – March 27, 2020

You sell insurance. The stock market has been falling. People around the nation are uneasy and confused. That little voice says “Not my problem.” Wrong. Your clients’ problems are your problems; you care about your clients. How can you be there for your clients? How should you build good will? How might you become their trusted agent going forward? Don’t just tell clients “I have no idea what’ll happen, I just wanted to call.” If you arm yourself with some answers (talk about this with your GM) and prepare an intelligent script, you can have some “If so, then …” answers. “If this happens, our analysts think this will happen.” You aren’t going to be doing a lot of prospecting during this crisis. Beyond being in bad taste, it’s been outlawed in places like New York State during its state of emergency. You might not be writing a whole lot of business, but you are making effective use of your time, and your clients will be impressed. Show them that you can be a good person and a friend, getting in touch with people you know near and far. Your clients know you can’t accurately predict the future, but they’ll certainly appreciate you showing an interest in them … and discussing some possible solutions.

READ COMPLETE ARTICLE

COVID-19 Update 3/25/20

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreWork from home transition

We continue to actively monitor the spread of COVID-19 and we successfully have 60% of our employees working from the safety of their homes. As we make the final push to get our remaining employees to work from home, we will be transitioning our remaining employees today 3/25/20 and tomorrow 3/26/20. By the close of business Thursday 3/26/20, everyone in our office will be working from home. We have business continuity plans to ensure a normal business operations but today and tomorrow we may experience a disruption in our normal operations. We appreciate your understanding patience during these unprecedented times. Our plan is to be back to normal operations Friday 3/27/20.

Annuity Telephonic Sales Utilizing Electronic Application (eApp)

These volatile times are a great reminder of the benefits provided with fixed annuities. If clients want a fixed/indexed annuity but do not want to meet in person, then we have a great solution! Take advantage of the carriers E-app solutions. These solutions are accessed via the carrier websites. If you use an E-app Solution, you can take the app over the phone with the client. All signatures and acknowledgments are done electronically. You do not need to physically meet with the client! We are happy to answer any questions. However, we are preparing a summary of our carrier partners E-app solutions and policies. We are creating a dedicated page to this topic and will share shortly.

We will continue to assess the situation and share more information as it becomes available. Please visit www.annuity1.com for the latest updates.

We will continue to be here to support you in these trying times.

Stay safe and Healthy!

Neal Lapierre

President

The Life and Annuity Shop, LLC.

Message regarding our Coronavirus Response

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierreAt The Life and Annuity Shop, LLC., the safety, health and well-being of our community, agent partners, and associates is our top priority. Like you, we are closely monitoring the quickly developing effects of the Coronavirus (COVID-19) pandemic, and adapting the way we do business accordingly.

As COVID-19 continues to evolve and spread throughout the country, we are taking the necessary precautions to protect our employees, which has included mobilizing members of our office-based team to work-from-home. Please know that our core focus is, and always has been, to provide the highest level of service to our valued agent partners.

Although any disruption to business should be minimal with this transition, we wanted you aware of this change in our business operations, should our response times be a little longer than usual.

We are all in this together. We will continue to monitor the COVID-19 situation and will follow guidance from public health officials and government agencies to continue to support our agent partners and communities.

For more information about COVD-19 and what you can do to keep healthy and safe, visit the Centers for Disease Control website at www.cdc.gov or your local health department’s website.

Sincerely,

Neal Lapierre

President

IRS Delays Tax Payment Deadline for 90 Days

/in Annuity News/by Neal LaPierreIRS Delays Tax Payment Deadline for 90 Days

March 18, 2020 by Melanie Waddell

Treasury Secretary Steve Mnuchin announced Tuesday that individuals would be allowed to defer up to $1 million in tax payments for up to 90 days. He also said the administration was considering sending checks to Americans.

“We encourage those Americans who can file their taxes to continue to file their taxes on April 15, because for many Americans, you will get tax refunds,” he said Tuesday in a news conference.

If you owe a payment to the IRS, you can defer up to $1 million as an individual, Mnuchin said. “The reason we’re doing $1 million is that covers lots of pass-throughs and small businesses and $10 million to corporations — interest free and penalty free for 90 days,” he said.

“All you have to do is file your taxes; you’ll automatically not get charged interest and penalties.”

Click HERE to read the full story via ThinkAdvisor

Originally Posted at ThinkAdvisor on March 17, 2020 by Melanie Waddell.

ECHOES OF 2008: ANNUITIES SURGE WHEN EQUITIES CRASH

/in Annuity News/by Neal LaPierreECHOES OF 2008: ANNUITIES SURGE WHEN EQUITIES CRASH

March 18, 2020 by Steve Morelli

The past few weeks of dramatic news might sound eerily similar to the 2008 crash, but there are some key differences for annuities, as well as some positive similarities.

Click HERE to read the full story via INN

…………………………………………………………………………………

Sheryl Moore, CEO of Wink, also said although this crisis has many similarities to the recession, the underlying financials are fundamentally different. Back then, FIA sales were so strong that some carriers had to stop selling for a while.

“That was a little different because capital was tight at the time,” Moore said. “There were huge capital constraints that really prevented companies from issuing much annuity business. And that’s not really an issue at this time, at least not yet.”

But one of the unusual features of this crash is a plummet not only in equities markets, but also in bond prices. That is odd because of the increased demand. So, that is creating a unique pressure on carriers that need safe investments to support reserves.

Moore said she is seeing many similarities to the last crash, such as the rate cuts.

“It’s very similar to 2008 from a product standpoint,” Moore said. “I’ve had companies dropping rates twice in the same day, over the past two weeks.”

ORIGINALLY POSTED AT INSURANCENEWSNET ON MARCH 16, 2020 BY STEVE MORELLI.

5.7-magnitude earthquake strikes near Salt Lake City, state’s largest quake since 1992

/in Annuity News/by Neal LaPierreThe quake was reported shortly after 7 a.m. local time.

Interest Rate Alert

/in Annuity News, Annuity Products/by Neal LaPierreDear Valued Producer,

I wanted to make sure all of you are aware of the dramatic recent changes in the financial markets, especially the bond market. The yield on the 10 year treasury has been declining for the last month but the decreases in yields have really accelerated over the past 5 days.

• On February 6, 2020 the yield on the 10 year treasury was 1.66%

• Today March 6, 2020 at 9:26am the yield on the 10 year treasury was 0.70%

• So over the last 30 days the yield on the 10 year treasury have dropped 96 bps!

• As a result investment yields on the insurance carrier’s portfolios are dropping and therefore they have lowered their new money rates and more importantly more Interest rate decreases are coming.

So I would strongly recommend that you meet with your clients and potential clients to advise them what is happening. Also encourage them to lock in the current rates now as it looks like interest rates will continue to go lower. Waiting will only end up costing them more money.

Please call us at (888) 661-1999 to discuss current annuity offerings available and upcoming interest rate decreases so you are aware of the time frames involved.

Below is a chart showing the decline in yield on the 10 year treasury over the last 30 days.

Neal Lapierre

President

The Life And Annuity Shop, LLC

AM Best Assigns Credit Ratings to Oceanview Life and Annuity Company and Oceanview Reinsurance Ltd.

/in Annuity News/by Neal LaPierreAM Best Assigns Credit Ratings to Oceanview Life and Annuity Company and Oceanview Reinsurance Ltd.

Originally Posted On Businesswire.com

OLDWICK, N.J.–(BUSINESS WIRE)–AM Best has assigned a Financial Strength Rating of A- (Excellent) and a Long-Term Issuer Credit Rating (Long-Term ICR) of “a-” to Oceanview Life and Annuity Company (Oceanview Life) (Denver, CO) and its reinsurer affiliate, Oceanview Reinsurance Ltd. (Oceanview Re) (Bermuda). The outlook assigned to these Credit Ratings (ratings) is stable. Both companies are ultimately owned by Oceanview Holdings Ltd.

The ratings of Oceanview Life reflect its balance sheet strength, which AM Best categorizes as strong, as well as its adequate operating performance, neutral business profile and appropriate enterprise risk management (ERM).

The ratings of Oceanview Re reflect its balance sheet strength, which AM Best categorizes as very strong, as well as its adequate operating performance, neutral business profile and appropriate ERM.

The ratings of Oceanview Life and Oceanview Re are anchored in the strength and quality of their balance sheets and overall liquidity sources. As a new company formation, AM Best requires a level of conservatism to be built into initial capital levels, and comfort is taken in the two companies’ material level of initial capital, which is approximately $100 million for each entity on day one. Further supporting the balance sheet assessments is the material committed equity capital to the ownership structure totaling $1 billion. Finally, AM Best’s final balance sheet assessment is further supported by additional capital and liquidity alternatives available to the company. AM Best also has assessed the quality of management to be experienced in the intended areas of focus. With respect to Oceanview Re, 100% of its capital qualifies as Tier 1 under Bermuda Solvency II equivalent regulatory system.

Additionally, AM Best stress tests of the companies also demonstrate a sufficient capital buffer to cover higher than projected asset impairments and excessive growth. The company also will apply to have access to Federal Home Loan Banks, further enhancing its liquidity profile.

Partially offsetting these positives is the concentrated asset allocation strategy and competitive product space in which Oceanview Life will be competing. AM Best therefore re-emphasizes the importance of a capital buffer, and additional equity commitments, from the start. Although concentrated, AM Best expects asset quality to be rated 100% investment grade. Products will include a portfolio of fixed annuity solutions, distributed through a diverse but untested network, which will place the companies in a highly competitive space from which to execute on its strategy.

This press release relates to Credit Ratings that have been published on AM Best’s website. For all rating information relating to the release and pertinent disclosures, including details of the office responsible for issuing each of the individual ratings referenced in this release, please see AM Best’s Recent Rating Activity web page. For additional information regarding the use and limitations of Credit Rating opinions, please view Understanding Best’s Credit Ratings. For information on the proper media use of Best’s Credit Ratings and AM Best press releases, please view Guide for Media – Proper Use of Best’s Credit Ratings and AM Best Rating Action Press Releases.

AM Best is a global credit rating agency, news publisher and data provider specializing in the insurance industry. The company does business in more than 100 countries. Headquartered in Oldwick, NJ, AM Best has offices in cities around the world, including London, Amsterdam, Dubai, Hong Kong,Singapore and Mexico City. For more information, visit www.ambest.com.

Copyright © 2019 by A.M. Best Rating Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

AM Best Upgrades Credit Ratings of Equitable Life & Casualty Insurance Company

/in Annuity News/by Neal LaPierreOLDWICK, N.J.–(BUSINESS WIRE)–AM Best has upgraded the Financial Strength Rating to B+ (Good) from B (Fair) and the Long-Term Issuer Credit Rating to “bbb-” from “bb+” of Equitable Life & Casualty Insurance Company (Equitable) (Salt Lake City, UT). The outlook of these Credit Ratings (ratings) has been revised to stable from positive.

The ratings reflect Equitable’s balance sheet strength, which AM Best categorizes as adequate, as well as its adequate operating performance, limited business profile and marginal enterprise risk management (ERM).

The ratings upgrade was based on Equitable’s improved operating performance. Over the last two years, the company delivered improving operating performance through profitable risk revenue development, which was driven by better underwriting scrutiny and increased investment returns. The impact of these adjustments resulted in a strong positive shift in Equitable’s operating gains through the second quarter of 2019.

The company’s balance sheet was strengthened by a significant capital infusion, providing the basis for the execution of its planned business expansion strategy. The improvement in balance sheet strength reflected the application of additional financial commitments to increasing the scale of the organization’s overall operations with particular focus on its annuity business…

Uncapped Accumulation FIA – 10% Bonus, 9% Comp & Top MYGA

/in Annuity News, Annuity Products/by Neal LaPierreJuly 4th Holiday Office Hours

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

The Life and Annuity Shop, LLC. Wishes everyone a safe and happy Independence Day!

In observance of this holiday, our offices will be closed on July 4th and 5th.

Memorial-Day Observance – our offices will be closed Monday, May 25th.

/in Annuity News, The Life And Annuity Shop News/by Neal LaPierre

The Life and Annuity Shop Staff honors and remembers the heroes who sacrificed in the service and protection of our country.

In observance of Memorial Day, our offices will be closed Monday, May 25th.

We will resume normal business hours Tuesday, May 26th.

Disclaimer

This site is not for the general public. It is for licensed insurance agents only.

No portion of this Web site, or information contained therein, can be reproduced on other public or private Web sites without express written consent by

The Life and Annuity Shop, LLC. Failure to comply with this policy will result in legal penalties.

Not affiliated with the U. S. government or federal Medicare program. This website is designed to provide general information on Insurance products, including Annuities. It is not, however, intended to provide specific legal or tax advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. Please note that The Life and Annuity Shop, its affiliated companies, and their representatives and employees do not give legal or tax advice. Encourage your clients to consult their tax advisor or attorney.

Latest Product & Annuity News

Memorial-Day Observance – Our offices will be closed Monday, May 26thMay 22, 2025 - 9:46 AM

Memorial-Day Observance – Our offices will be closed Monday, May 26thMay 22, 2025 - 9:46 AM New Limited Distribution| FIAMarch 13, 2025 - 12:15 PM

New Limited Distribution| FIAMarch 13, 2025 - 12:15 PM Axonic Waypoint MYGAFebruary 24, 2025 - 4:18 PM

Axonic Waypoint MYGAFebruary 24, 2025 - 4:18 PM ❄️ Best Wishes This Holiday Season ❄️ and Holiday Office ClosuresDecember 20, 2024 - 2:25 PM

❄️ Best Wishes This Holiday Season ❄️ and Holiday Office ClosuresDecember 20, 2024 - 2:25 PM Thanksgiving 2024 Holiday HoursNovember 25, 2024 - 2:38 PM

Thanksgiving 2024 Holiday HoursNovember 25, 2024 - 2:38 PM